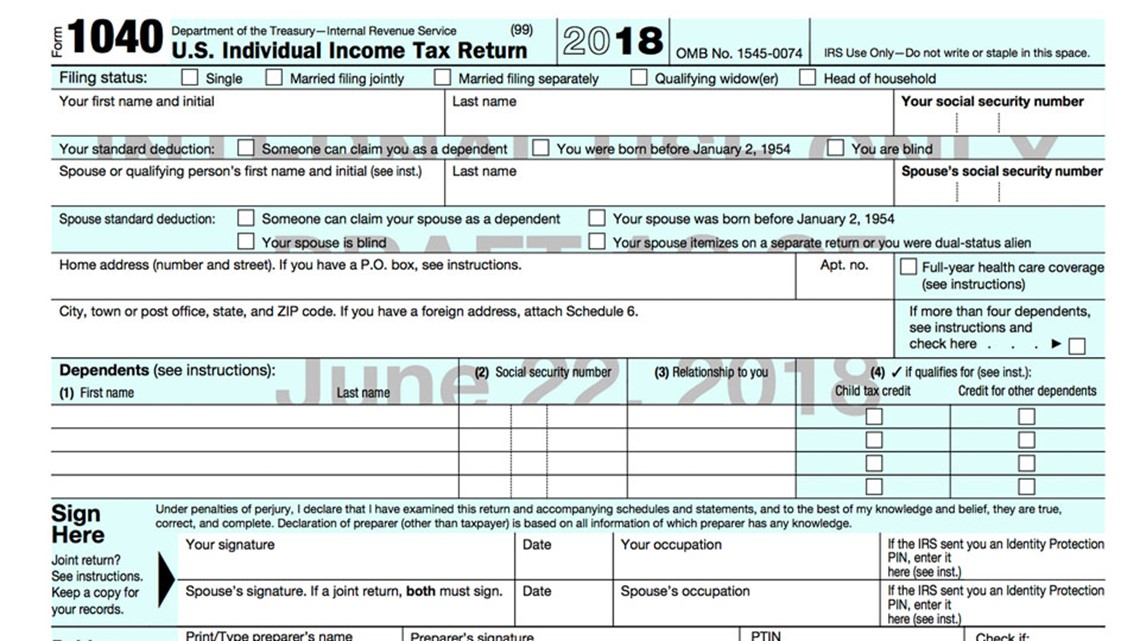

According to their website, there are two official ways you can file your income taxes: via mail or online. You cannot fax your Form 1040 directly to the IRS. After that, it’s time to crunch the numbers and calculate your adjusted gross income (AGI) based on the income you declare. Once that’s done, you can proceed to the second page, which asks for your signature and your occupation. You will also be required to include the information of your spouse if you are married.

IRS 1040 FORM FULL

The first page asks for your basic personal information such as your full name, completed address, Social Security Number (SSN), and so on. The contents are pretty similar to the standard 1040 tax form, but the fonts are much bigger for better readability.įorm 1040 is composed of two pages.

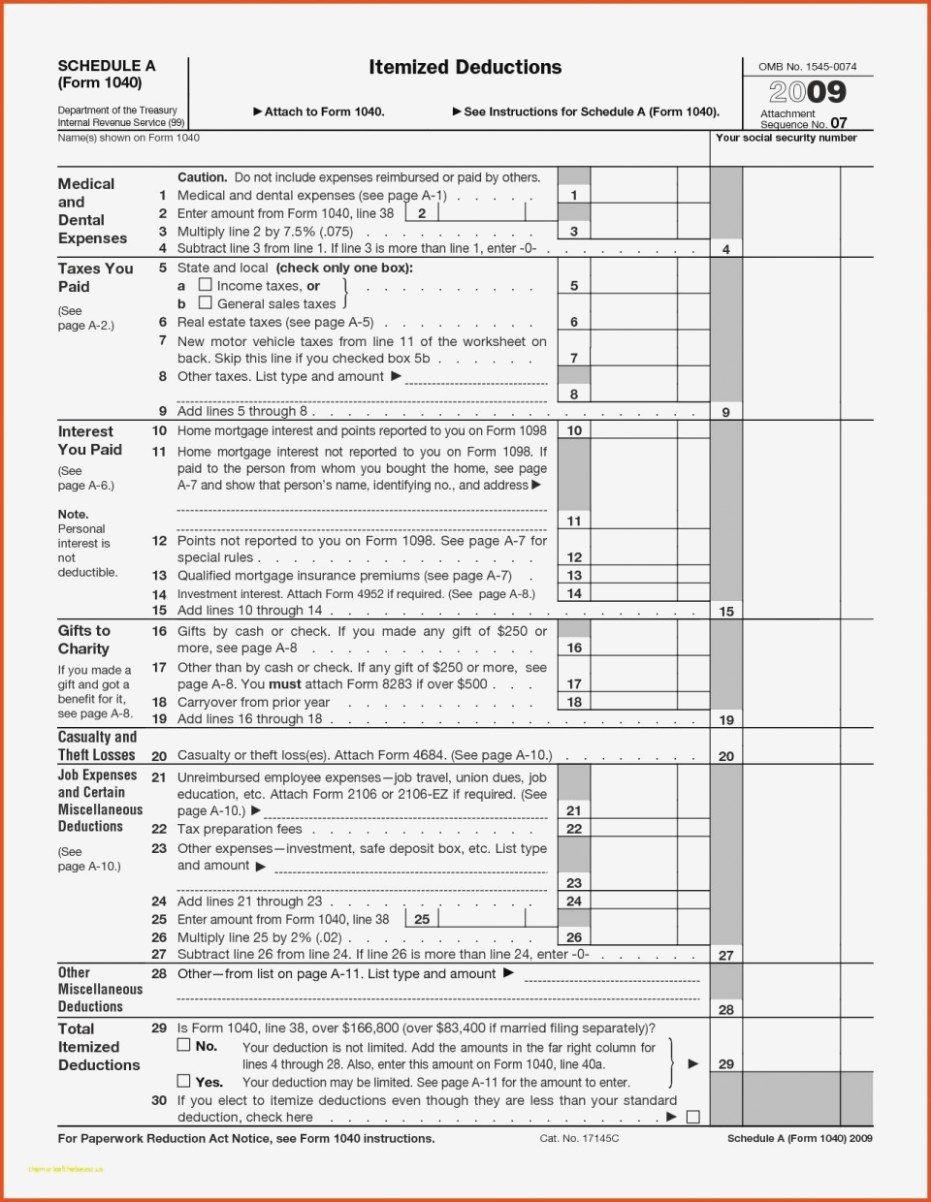

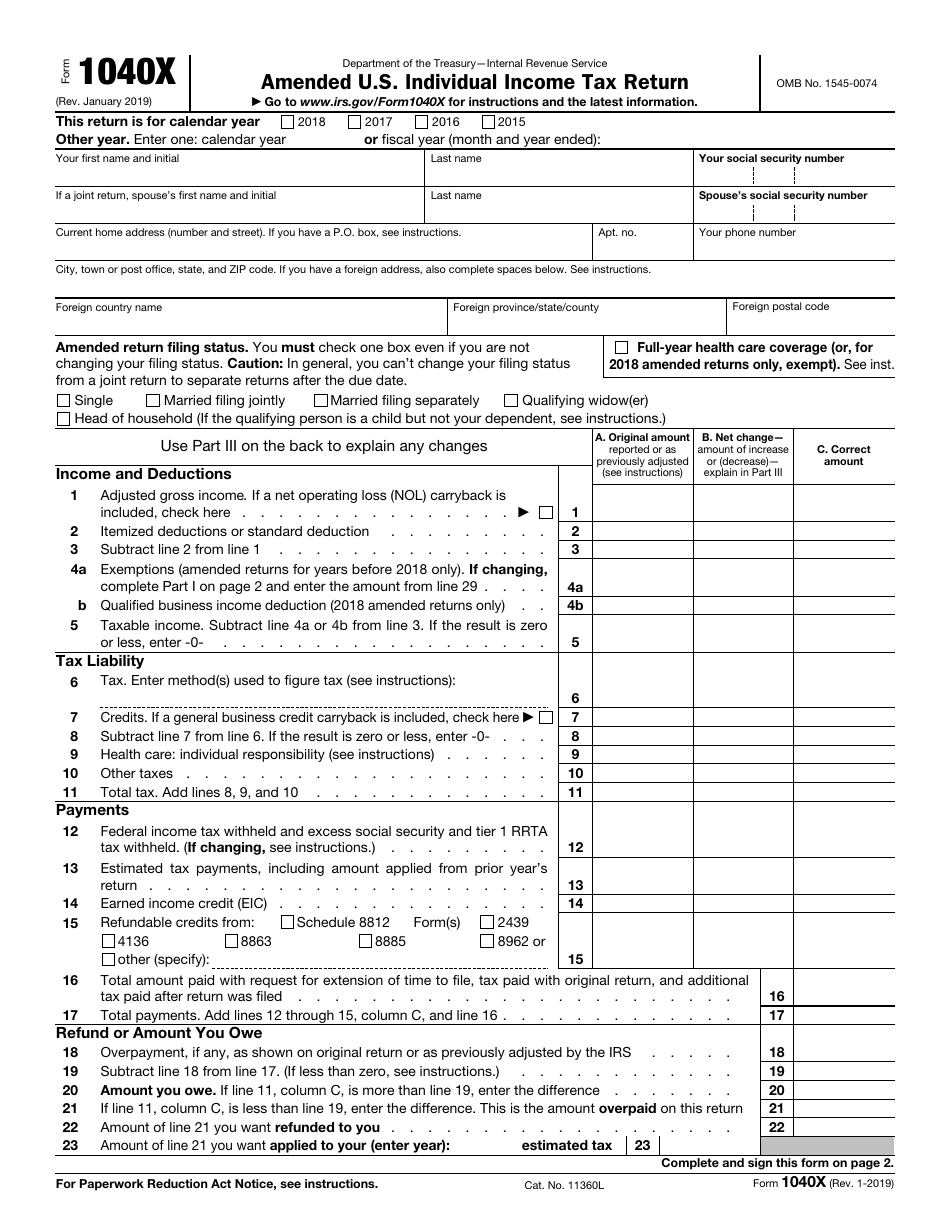

This form is for taxpayers who are aged 65 years and older. You must file this form if you have any pending unpaid balance on the “amount you owe” line of your Form 1040. This form is used by taxpayers who pay estimated quarterly taxes. If you are a non-resident alien or you’re filing on behalf of a deceased person, you can use this form to file your ITR. There are various kinds of tax forms under the 1040 designation, including: The form calculates your total taxable income and the deductions you wish to claim. It is one of the standard Internal Revenue Service (IRS) documents that US taxpayers use to file their annual income tax returns. The IRS 1040 Form is formally known as Form 1040: US Individual Income Tax Return (ITR).

IRS 1040 FORM HOW TO

In this article, we will provide you with a comprehensive guide that covers the basic things you need to know about how to fax a 1040 tax form. There is nothing worse than doing taxes at the last minute. To make this task more manageable, you should sort everything out as early as you can. Crunching numbers and paying large sums of money is not exactly the most exciting to do. For forms and publications, visit the Forms and Publications search tool.Filing income taxes is probably one of the most stressful aspects of being a professional. We cannot guarantee the accuracy of this translation and shall not be liable for any inaccurate information or changes in the page layout resulting from the translation application tool.įorms, publications, and all applications, such as your MyFTB account, cannot be translated using this Google™ translation application tool. For a complete listing of the FTB’s official Spanish pages, visit La esta pagina en Espanol (Spanish home page). These pages do not include the Google™ translation application. We translate some pages on the FTB website into Spanish. If you have any questions related to the information contained in the translation, refer to the English version. Any differences created in the translation are not binding on the FTB and have no legal effect for compliance or enforcement purposes. The web pages currently in English on the FTB website are the official and accurate source for tax information and services we provide. Consult with a translator for official business. This Google™ translation feature, provided on the Franchise Tax Board (FTB) website, is for general information only.

0 kommentar(er)

0 kommentar(er)